Both parties understood that the reimbursement rate was subject to change as the product moved to a more permanent rate, although neither viewed the risk of a drastic rate shift as substantial. Before January 2021, CAM devices were reimbursed at a temporary rate of $365 per patch, and this rate served as the basis for the $375 million negotiated purchase price.

Bardy diagnostics logo Patch#

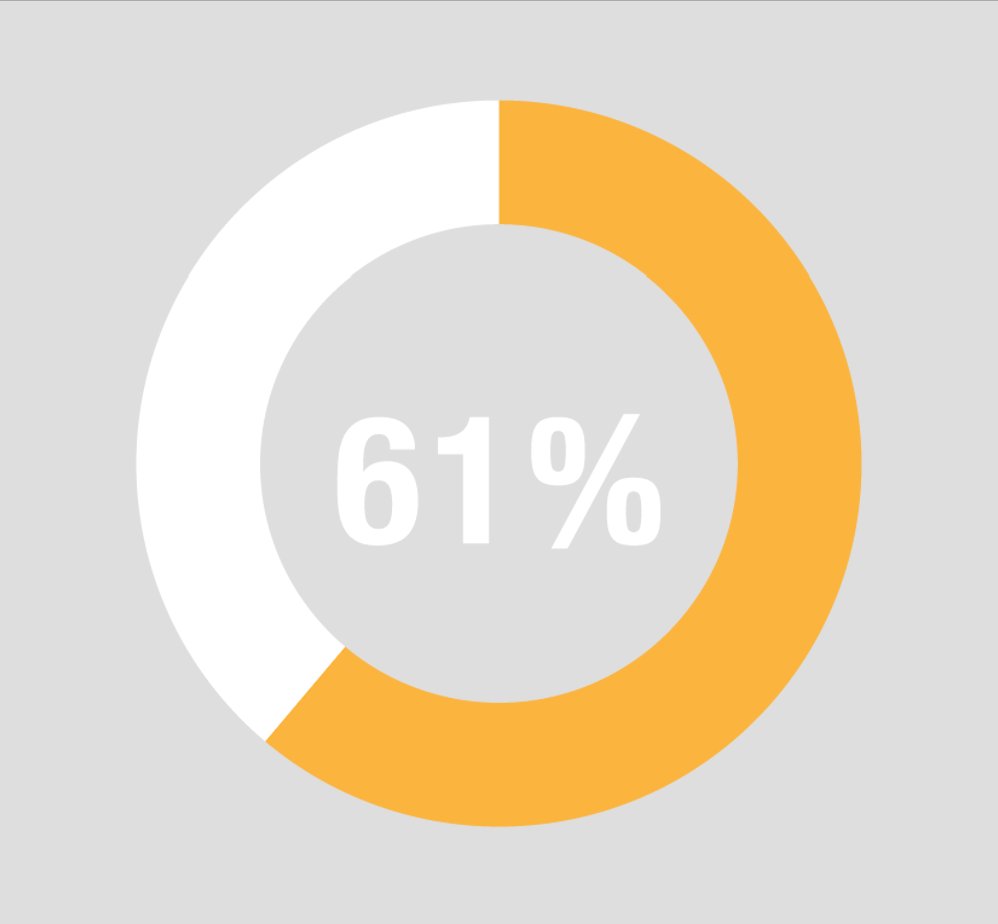

Bardy’s appeal was its best-in-class ambulatory electrocardiogram device, a patch marketed as the Carnation Ambulatory Monitor (“CAM”).īardy’s largest revenue outlet was servicing Medicare patients, representing 29 percent of Bardy’s revenues.

In January 2021, Hill-Rom, a public medical technology company, began pursuing an acquisition of the medical device startup Bardy.

Despite acknowledging that the attempted Hill-Rom termination was not the typical case of “buyer’s remorse” and likening the hit that the rate reduction had to Bardy’s prospective earnings as a “Tyson right uppercut,” the Court declined to find that an MAE occurred and granted Bardy’s request for specific performance to force Hill-Rom to close the merger. Most notably, the Court (1) expanded on Delaware precedent that a purchaser seeking to terminate a signed acquisition agreement on account of an MAE must prove by a preponderance of the evidence that the event in question was “durationally significant” and (2) narrowly applied the “disproportionate effect” exception to the carve-outs of the MAE definition that would have allowed Hill-Rom to avoid closing if the event had been found to have a disproportionate effect on Bardy relative to similarly situated companies operating in the same industries. In its analysis, the Court applied the prima facie elements for determining whether an event constitutes an MAE. (“Bardy”) claiming a material adverse effect (“MAE”) had occurred following a surprisingly drastic 86 percent reduction in the Medicare reimbursement rate for Bardy’s sole marketed product during the interim period between signing and closing. (“Hill-Rom”) to walk away from a $375 million merger with Bardy Diagnostics Inc. 2021-0175-JRS, denied the attempt by Hill-Rom, Inc. On July 9, 2021, the Delaware Court of Chancery (the “Court”), in Bardy Diagnostics, Inc.

0 kommentar(er)

0 kommentar(er)